FATCA compliance continues to be a priority for financial institutions as IRS enforcement ramps up in 2025. With Q3 deadlines fast approaching, the risks of non-compliance—ranging from hefty penalties to reputational damage—are higher than ever. This article explores the consequences of FATCA non-compliance and provides actionable steps to help your organization stay on track.

The Financial Impact of FATCA Non-Compliance in 2025

Financial institutions failing to meet FATCA obligations face serious consequences:

- 30% Withholding Tax: Applied to all U.S.-source income payments to non-compliant entities.

- Reputational Damage: Affects credibility, client retention, and strategic partnerships.

- Operational Disruptions: IRS audits divert internal resources and create bottlenecks.

- Fines and Penalties: Additional sanctions for late or incorrect reporting.

Key Insight: With increased coordination under the Common Reporting Standard (CRS), FATCA non-compliance may also trigger scrutiny from global tax authorities.

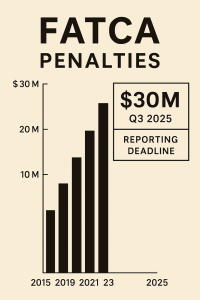

Key IRS Enforcement Trends in 2025

- Advanced Data Analytics: AI and machine learning tools now detect anomalies faster and more accurately.

- International Collaboration: CRS partnerships are creating a global web of compliance checks.

- More Frequent Audits: Financial institutions will see higher audit volumes starting Q3 2025.

How to Avoid FATCA Penalties: A 4-Step Guide

- Conduct Regular Internal Audits

→ Identify gaps in classification, due diligence, and account reporting. - Leverage Compliance Technology

→ Automate FATCA workflows using platforms like Opes Software to minimize human error and meet IRS deadlines. - Train Your Teams

→ Ensure legal, compliance, and finance teams are trained on current FATCA rules and practices. - Consult Compliance Experts

→ Stay ahead of evolving regulations by working with IRS or FATCA-specialized legal advisors.

Don’t let FATCA non-compliance put your organization at risk. Discover how Opes Software can help you stay compliant and avoid IRS penalties. Request a demo today.

Frequently Asked Questions

What are the penalties for FATCA non-compliance in 2025?

- 30% withholding on U.S.-source income

- Additional fines for inaccurate or late filings

- Operational disruptions from increased IRS audits

What is Form 8966, and why does it matter?

- Form 8966 is used to report financial accounts held by U.S. taxpayers.

- It is a mandatory element of FATCA reporting. Filing errors or delays can lead to penalties.

Conclusion

FATCA compliance is no longer optional. With IRS and global tax authorities tightening enforcement, Q3 2025 marks a critical moment for financial institutions. Now is the time to audit your systems, train your staff, and adopt the right technology to stay ahead of the curve.