FATCA compliance remains a complex, time-consuming process for financial institutions. With the December 2025 deadlines fast approaching, institutions face increasing pressure to meet reporting requirements accurately while avoiding penalties. This article explores actionable strategies and tools to help financial institutions streamline their FATCA compliance processes, reduce manual workload, and maintain full regulatory alignment.

The Challenges of FATCA Compliance

Why FATCA Compliance Is Complex for Financial Institutions

-

Vast Amounts of Data

Financial institutions must process and analyze huge volumes of account-holder information to identify U.S. taxpayers. -

Regulatory Changes

Ongoing updates to FATCA regulations make staying current a constant challenge. -

High Stakes

Non-compliance can result in a 30 % withholding tax on U.S.-source income, operational disruptions, and reputational damage. -

Resource Intensity

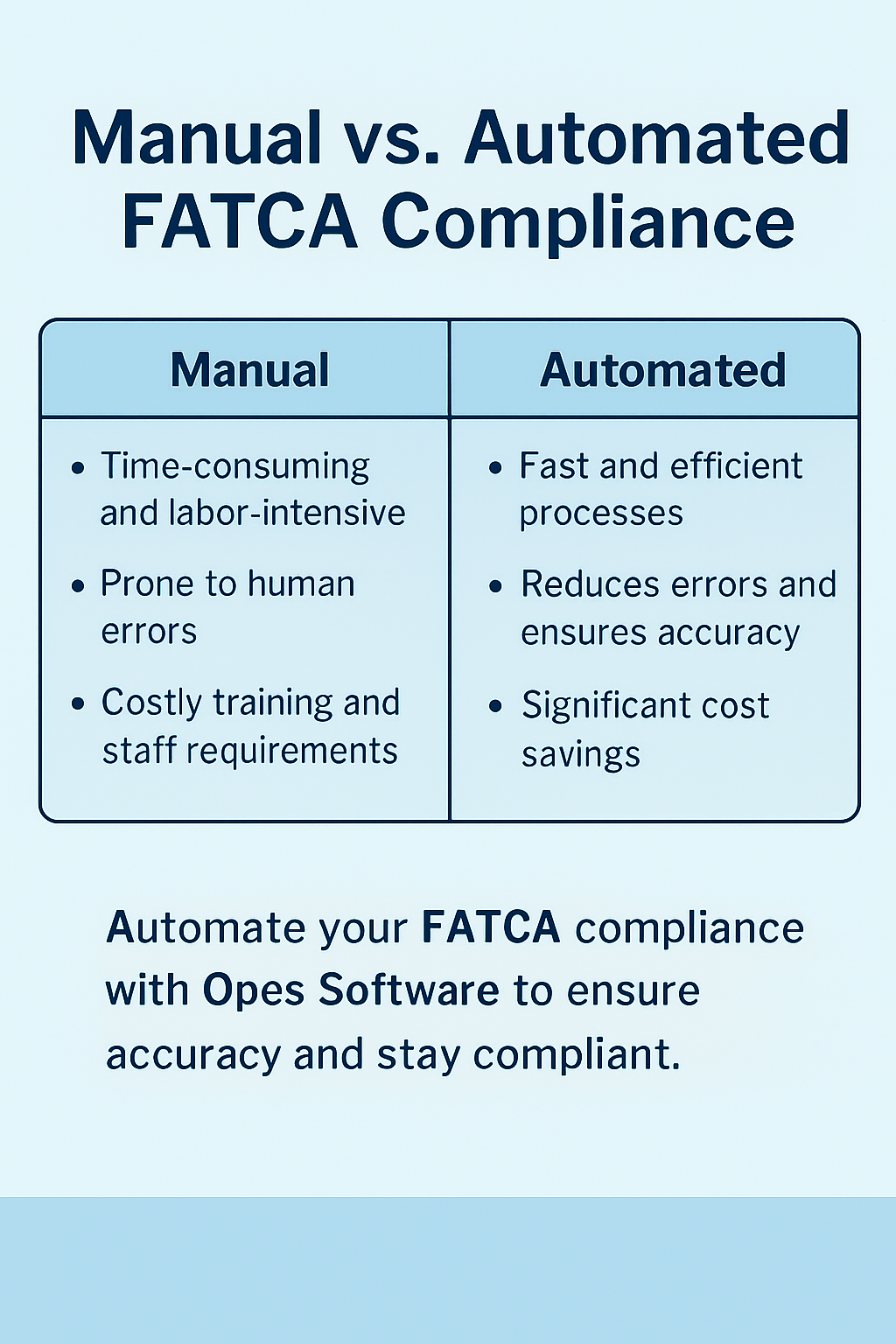

Manual compliance processes require significant time, training, and financial investment.

How Financial Institutions Can Simplify FATCA Compliance

Actionable Steps to Streamline FATCA Compliance

1. Automate Reporting with Advanced Tools

-

Use specialized software such as Opes Software to automate FATCA reporting and reduce human error.

-

Automation ensures timely submissions, real-time updates on regulatory changes, and accurate Form 8966 generation.

2. Centralize Data Management

-

Consolidate account-holder data from all internal systems into a secure, unified platform.

-

Ensure your platform identifies U.S. taxpayers and can seamlessly produce required FATCA forms.

3. Conduct Regular Compliance Audits

-

Plan quarterly or semi-annual audits to identify compliance gaps early.

-

Verify account classifications, data accuracy, and adherence to the IRS submission timeline.

4. Provide Staff Training

-

Implement continuous training sessions for compliance teams.

-

Updated knowledge ensures reduced error rates and smoother audits.

5. Partner with Experts

-

Collaborate with legal and tax compliance advisors who can help your organization stay aligned with evolving FATCA and CRS rules.

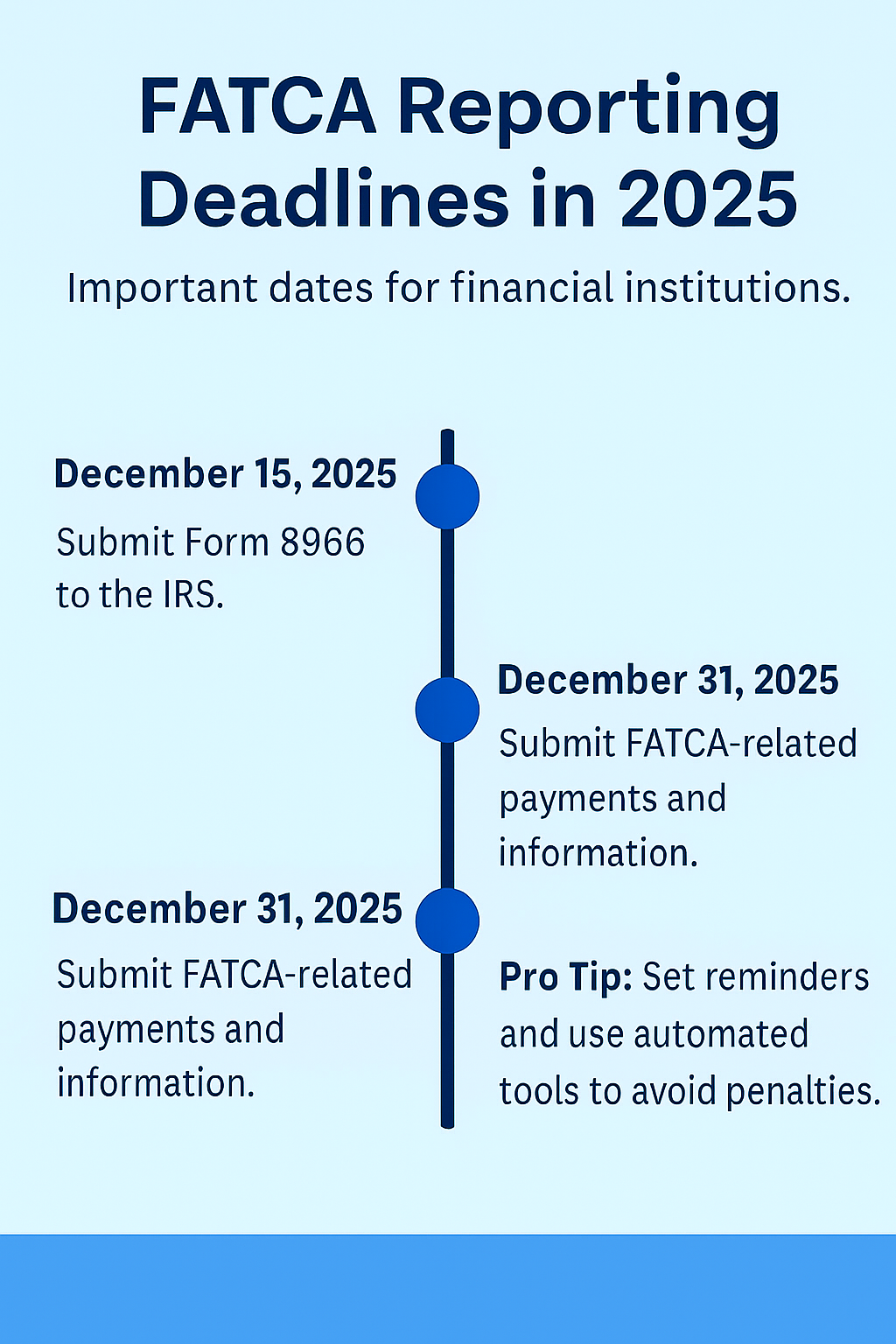

Key Dates and Deadlines for FATCA Compliance in 2025

FATCA Reporting Timelines to Remember

-

December 15, 2025: Deadline for financial institutions to submit Form 8966 to the IRS.

-

December 31, 2025: Final date for withholding agents to submit FATCA-related payments and accompanying information.

Pro Tip: Missing these deadlines can trigger automatic withholding and penalties. Use compliance automation tools to ensure reminders and submissions are error-free.

Conclusion

Meeting FATCA requirements doesn’t have to be overwhelming. Through automation, data centralization, and proactive audits, financial institutions can simplify their compliance processes and minimize risk.

With the December 2025 deadline approaching, now is the time to act.

For more information, tools, and customized compliance solutions, visit Opes Software today.